China continues to grow rapidly (both as a destination market and as a machinery manufacturer and exporter), Germany is stagnant, and the United States has been stagnant for three years (waiting to see the effects of tariffs).

Reading the latest manufacturer news from the AMP Amaplast website, the following conclusions can be drawn:

Europe:

Most dynamic markets: Italy (strong investments in medical, automation, new facilities), Germany (foreign expansion of Italian companies and technological consolidation).

Improving trend: specialized segments (medical, automation, tube processing systems).

Contracting: Austria (Engel downsizing), additive manufacturing in Germany (Arburg closes its department).

Asia:

Most dynamic markets: China (global leadership), India (strong investments), Indonesia (new hub for multiple manufacturers).

Improving trend: Japan (strengthening of Niigata), Korea (international expansion).

No evident contraction; indeed, marked expansion prevails.

Americas:

Most dynamic markets: USA and Canada, with acquisitions and service expansion, but primarily by non-US players.

Improving trend: Mexico and Brazil, driven primarily by expanding Chinese companies.

No contraction reported, but the main driver remains Asian and European initiatives.

So, the summary is:

Areas with the most marked growth:

China and Asia: global driving force, with international expansion (India, Indonesia, emerging hub).

Italy: very dynamic in medical, automation, strategic collaborations, and industrial expansion.

USA and North America: attractive for acquisitions and service expansion.

Areas with prospects for improvement:

India: strong attraction for industrial investments.

Indonesia: new strategic hub for research, training, and support.

Germany: despite some downsizing, remains a hub for technological collaboration.

Contracting areas:

Austria (Engel): persistent market decline, staff reduction.

Germany (Arburg): abandonment of the additive manufacturing market, with a contraction in an innovative segment.

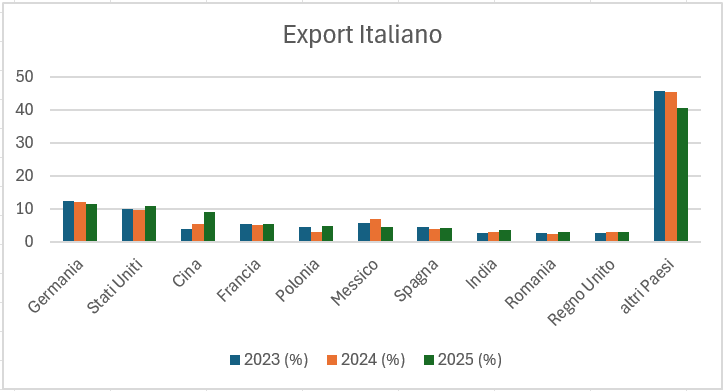

Data on Italian exports of machinery, equipment, and molds for plastics and rubber, again from AMP Amaplast, also confirm that strong and constant growth since 2023 is seen only in China, while all other major markets are fluctuating or even in constant decline.